As far as individual accounting and vocation arranging, it’s essential to comprehend how much your time-based compensation converts into yearly. Thus, for those procuring $35 each hour or mulling over a proposition for employment at that rate, it’s basic to contemplate this number according to a yearly point of view and plan how you’ll deal with your funds successfully.. This blog post aims at demystifying the calculation, discussing financial implications as well as giving insights on budgeting, saving and optimizing your earnings at this level.

Breaking Down the Numbers

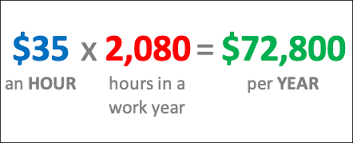

To find out how much $35 an hour amounts to in one year we need to consider what constitutes a standard work year. Below is the basic formula:

[ \text{Annual Salary} = \text{Hourly Wage} \times \text{Hours Worked Per Week} \times \text{Weeks Worked Per Year} ]

Expecting a 40-hour full-time program every week and an ordinary work-year of 52 weeks (disregarding occasions and excursions), the condition would be composed as follows:

\[ \$35 \times 40 \times 52 = \$72,800 \]

What might be compared to working for $35 each hour is acquiring a yearly compensation of $72800.

Understanding the Impact of Taxes

However, what smashes into your bank account isn’t your gross income. Federal taxes and other necessary assessments including state and sometimes local taxes may also reduce social security or medicare contribution hence decreasing net income extent substantially. In order to simplify things if we assume average tax rate of 25% (though this will differ greatly depending on where you live among other considerations), then your take home pay would be approximately 75% of your gross wages:

\[ \$72,800 \times 0.75 = \$54,600\]

To summarize, this back-of-the-envelope calculation shows about $54,600 of net income per annum or roughly $4,550 each month.

Budgeting on a $35 an Hour Wage

However, effective budgeting depends on knowing your inflows as well as your outflows. With around $4,550 of net income every month, it would be important to use a budget rule such as the 50/30/20 rule which means:

50% of your money pays for needs (rents, utilities and groceries)

30% goes for indulgences (dining out, entertainment and hobbies)

And 20% is allocated to debt repayment or savings etc.

By changing these percentages relative to individual wants and responsibilities like student loans or mortgage payments can help create a financial plan that works for you.

Maximizing Your Financial Health

Emergency Funds

The emergency fund must be built. At this level of income try saving at least three to six months’ worth of living expenses in case there are any financial problems that come up unawares.

Retirement Savings

Making contributions to retirement accounts like 401(k)s or IRAs may significantly shape one’s future endeavours. If an employer has a 401(k) match offer make sure you contribute enough to get the full amount since it’s almost free money.

Investments

One might also consider ensuring diversified income through investing. This could vary from stock markets to commercial and wholesale real estate all the way to further education so as to enhance earning power.

Conclusion

However, while making $35 per hour means earning gross annual salary amounting to$72800; what matters is the net income received and how it is managed. By understanding how much you earn from various sources breakdown wise can help one plan better on taxes saving and spending too. Always remember that whatever its magnitude may be, financial planning and literacy are important in order maximize your cash-inflow possibilities.

Additional Considerations for Financial Planning

Having discussed the fundamentals of managing a wage with an hourly rate of $35, there are other aspects in relation to financial planning that should be considered for improved financial well-being.

Health Insurance and Benefits

One region the vast majority disregard with regards to their monetary plans is health care coverage cost and inclusion. Assuming that your boss offers health care coverage, comprehend the expenses, deductibles and personal maximums.. These figures have a direct effect on your net pay as well as financial planning. For those without benefits from an employer or self-employed individuals shopping at Health Insurance Marketplace or considering health sharing plan can also help.

Education and Professional Development

Investing in yourself by getting further education or professional certificates can significantly raise your earning potential. Various employers offer tuition assistance programs. Further still, online courses and night classes provide flexibility for improving skills while working. This is a long term investment which can lead to career growth and higher incomes.

Flexible Spending Accounts (FSAs) and Health Savings Accounts (HSAs)

In case they are provided, one may think about making contributions towards FSAs or HSAs respectively. These accounts enable you deduct money before taxes for qualified medical costs hence effectively reducing your taxable income. In addition, HSA allows for roll over of any unused funds each year plus such funds can be invested thus increasing healthcare savings on tax-free basis.

Leveraging Side Hustles

These days’ gig economy makes it possible that a side hustle could add to one’s salary scale. It could be freelancing; selling handmade items via various online platforms offering service based on personal skills etc., not only do these drives increase one’s cash flow but also might help realize passions/hobbies potentially turning them into very remunerative businesses.

Financial Advising

Finally, it may be advantageous to get advice from a financial advisor who specializes in such matters. Personal finance is not simple so having someone with knowledge lead you through investing ideas even taxation planning or retirement planning can give you peace of mind and confidence towards financial security.

Staying Flexible and Informed

Flexibility and being informed are vital in making successful financial plans. Financial situations change; laws become different, individual needs alter, economic conditions shift. Regular revision and retuning of your financial plan allows for an efficient and effective adaptation to the evolution of life. Being proactive concerning money learning as well as planning will allow those who earn $35 per hour optimize their finances, realize their dreams, and also build a sound financial future.